UK April government borrowing report now out 23 May

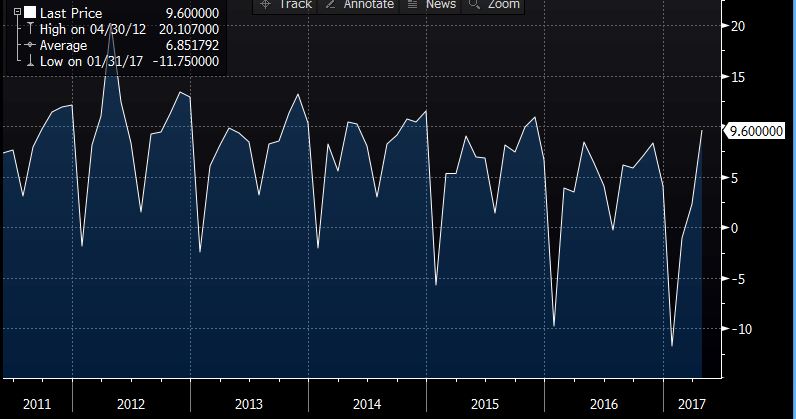

- 2.3bln prev revised down from 4.4bln

- PSNBR ex banking groups GBP 10.4bln vs 8,7bln exp vs 3.1bln prev revised up from 5.1bln

- PSNCR -15.2bln vs -27.7bln prev revised down from 34.3bln

- central govt NCR -15.2bln vs 18.3bln prev

A surprise increase in borrowing for April.

Despite a decrease of £23.8bln since April 2016 the ONS warn:

- The Office for Budget Responsibility (OBR) forecast that public sector net borrowing (excluding public sector banks) would be £51.7 billion during the financial year ending March 2017. During the financial year ending March 2018, OBR forecast public sector net borrowing (excluding public sector banks) to be £58.3 billion.

Full report here

Government finances not going to improve rapidly anytime soon despite how many times PM May goes on about the "strong economy" will pay for everything. Noticeably lacking in detail on last night's BBC Andrew Neill interview. As for strong economy, really?

The lady is definitely for turning and rightly is seeing her lead cut in the latest UK election polls. I did say at the outset that shorting the number of Tory seats would be my chosen play as the contest might prove tighter than most thought.

Meanwhile GBPUSD going nowhere in a hurry at 1.2988 Ditto EURGBP at 0.8660