Making a case for CFDs

This article is written by John Horlock, Director - CFDs, at ADS Prime.

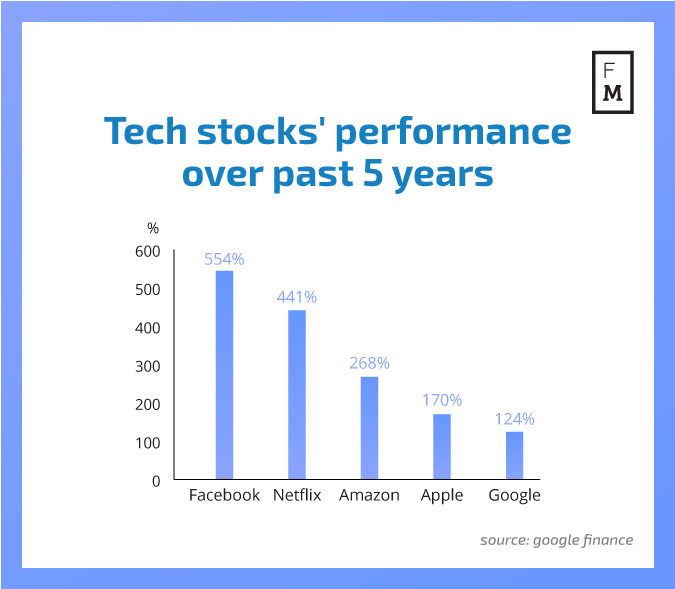

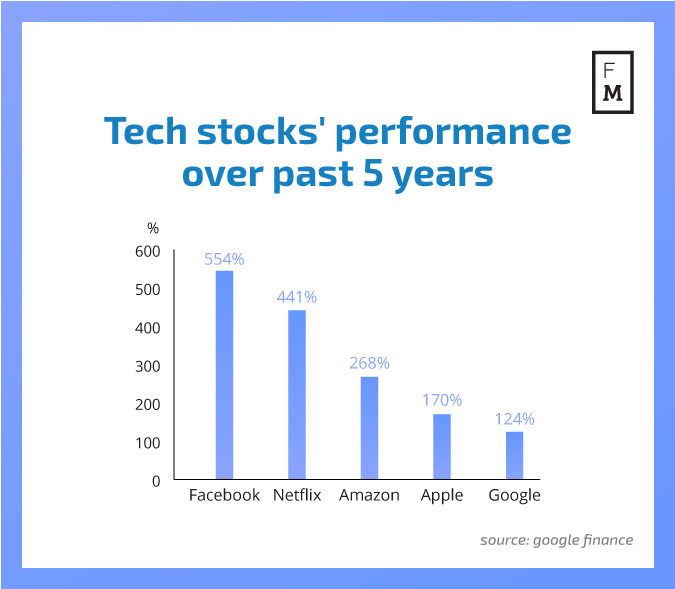

Many headlines have been written about the incredible rise in value of the so-called FAANG stocks listed on Nasdaq and traded as part of the S&P 500. In the last four years, the five stocks have advanced by 544 percent (Facebook), 268 percent (Amazon), 170 percent (Apple), 441 percent (Netflix), and 124 percent (Google/Alphabet) respectively.

These stats are quite simply daunting, especially if you look in more detail at these giant tech companies and the rise of the FAAMG stocks, a term coined by Goldman Sachs who dropped Netflix and included Microsoft.

INTERESTED IN CFDs? LEARN MORE HERE

From the start of the year (2017) these stocks have accounted for one-third of the gains on the S&P 500 (SPX). They now make up 13 percent of the SPX by market cap and 42 percent of the Nasdaq index (NDX). Between them they are responsible for 40 percent of SPX's year-to-date (YTD) performance and 55 percent of the NDX's YTD performance. Together, the FAAMG stocks have generated $660 billion in market capitalization in 2017 alone.

Good times

If you have been invested in US tech equities for a period of time then you are probably very happy with this information and, while the recent 'wobble' in the tech markets may have made you consider your exposure in this sector, it would take a lot of pain to take away the gain.

However, if you have a diverse portfolio and you are looking for ways to access the market, you may be watching the US tech equity markets very carefully. US bourses are trading at all-time highs amidst a buoyant earnings season and fuelled by a continued low interest rate environment and associated 'cheap money', which has come from a number of quantitative easing programs.

Unfortunately, the more that talk turns to a 'bubble' in the market, the more likely it is that we will see a major correction. After nearly a ten-year bull run on equities there is certainly room for significant value to be lost very quickly. As such, many physical equity investors have started to explore alternative routes to enable them to balance their risk and allow them to become less correlated with the market. This has led many to consider the use of CFDs.

Making a case for CFDs

A CFD, or Contract for Difference, is a contract between two parties (for example the client and ADS Securities) to exchange the difference in value of an underlying instrument between the time when the contract is opened and when it is closed. Not needing to own the underlying asset gives CFDs much higher leverage than usual trading methods, with as low as 0.5% margin requirement as standard.

As well as the lower capital outlay, investors will benefit from the fact that a broker will often not charge a fee for the trade, instead this is covered by the trader effectively paying for the spread. A very popular instrument at the moment, for investors who believe that the US indices have reached their peak, is the S&P500, but many investors take out CFDs on individual tech stocks.

Talking exposure

As a trader you can gain exposure to a range of assets but the main advantage of trading a CFD is that you can go long or short without having to physically own the underlying product. So, if your view is that the tech bubble is about to burst, or that the Dow Jones is heading straight to 25,000, then you can take out a CFD based on your analysis, whether this is bullish or bearish.

One of the weaknesses with the current market structure has been the rise in passive investing which is now outstripping active fund management, the old school 'stock-picker' approach.

The problem is that passive funds tend to opt for ETFs and market tracking options, which give great returns for low fees, when the markets are going up. But this high level of correlation across assets creates huge levels of systemic risk. In the event of the US tech equity bubble bursting, and you are holding FAANG or FAAMG stocks through tracking an index, you have no option but to chase the price lower.

You will be holding an investment, which will lose value, and buyers, very quickly. However, if you were to short the NDX, SPX or an individual stock through an ADS Securities CFD, you have spread your risk and potentially maximized your profit. CFDs are an important part of an investment portfolio offering flexibility to trade the market in each direction and without holding the underlying asset.