Forex and Bitcoin news from the European morning trading session 16 Feb 2018

- USD demand the play of the day so far

- Swiss financial regulators say each ICO case must be decided on individual merits

- Coeure says ECB interest rates will not rise before bond-buying ends

- Japan's Asakawa says FX moves are one-sided

- Japan's Suga says Kuroda has demonstrated ability to help exit deflation

- EU's Barnier says UK red lines close the door to a Swiss/Norway model for Brexit

- Germany's Merkel says there is a good chance that SPD members will approve coalition deal

- EURUSD orders 16 Feb - Large option contracts casting a shadow again

- FX option expiries for the 15.00 GMT cut - 16 Feb 2018

- AUDUSD orders 16 Feb - Large option interest in play

- European equity markets open firmer 16 Feb

- Trading ideas for the European session 16 Feb

- Nikkei 225 closes up 1.19% at 21,720.25

- ForexLive Asia FX news: Kuroda secures a second term ... yen likes !!!!!

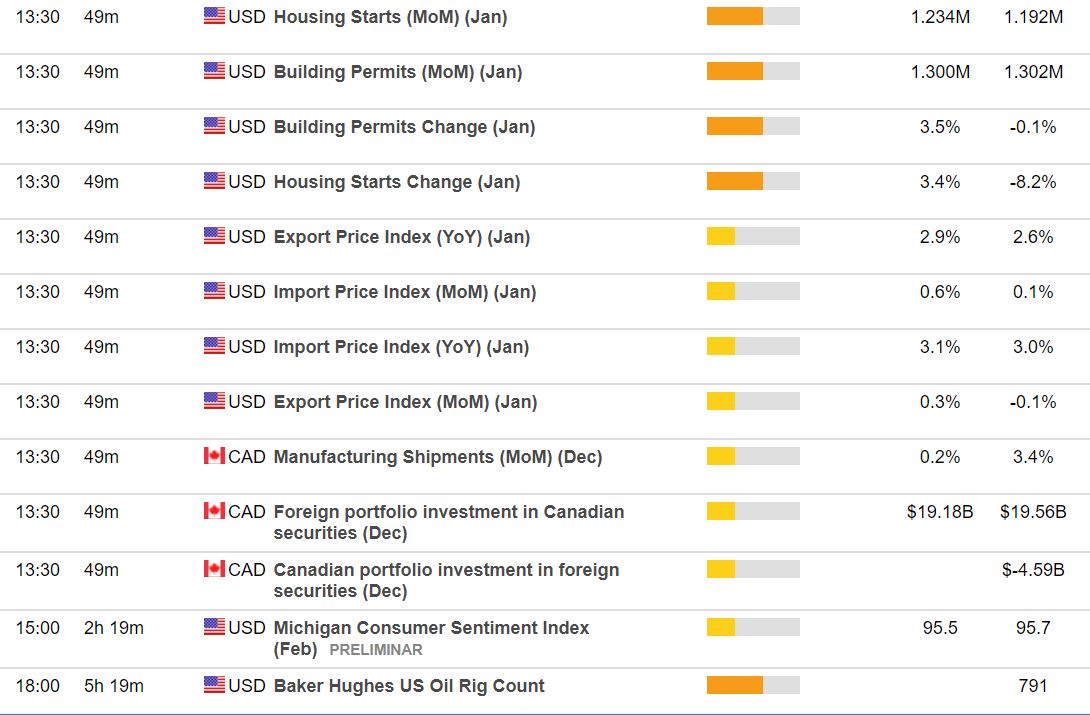

Data:

Bitcoin a Bubble? Five insights from the ASAC Fund

It's been a busy session, albeit scrappy, and one that's seen USD demand prevail overall although not in a straight line. Bitcoin/cryptocurrencies have been in retreat.

USDJPY found support/demand into 105.50 and bounced to hang around 105.75 for a while, then a couple of attempts to breach 106.00 before finally breaking higher to 106.30

USDCHF has needed little excuse to make its way higher to 0.9243 from 0.9190 with EURCHF still underpinned into 1.1500 albeit finding rally sellers .

EURUSD briefly traded above 1.2550 late in Asia but since then it's mostly been a one-way street down to 1.2470 with large option contract expiries very much in play too. Likewise AUDUSD which has fallen back from 0.7989 to post 0.7940 with large expiries at 0.7950 impacting.

GBPUSD had posted 1.4146 but then began a retreat into 1.4100 ahead of UK retails sales data only to hold up on weaker data as option-led demand prevailed. All to no avail though as the USD demand sent the pair down to 1.4055. EURGBP has large sell interest/res between 0.8885-00 and that's capped rallies again so far

USDCAD has made its way to 1.2495 with options at 1.2475 and 1.2500 in play amid the general USD buying while NZDUSD failed above 0.7430 to test 0.7400.

Bitcoin began in Europe at $10150 but then came down to test $9700 only to bounce back to $10000 before failing again

Equities have had a positive session while oil has been tightly bound by and large. Gold has fallen from $1360 to $1354.

Data coming up: