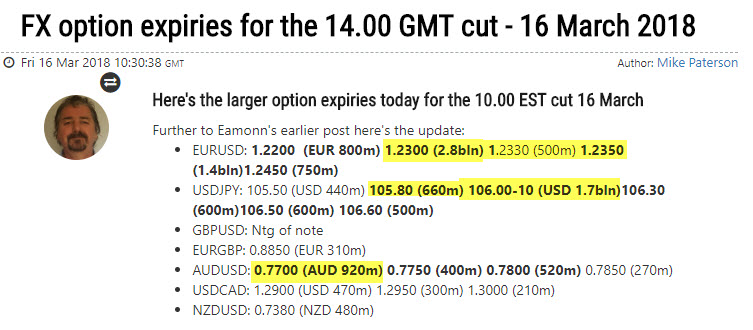

$2.8B at 1.2300 level

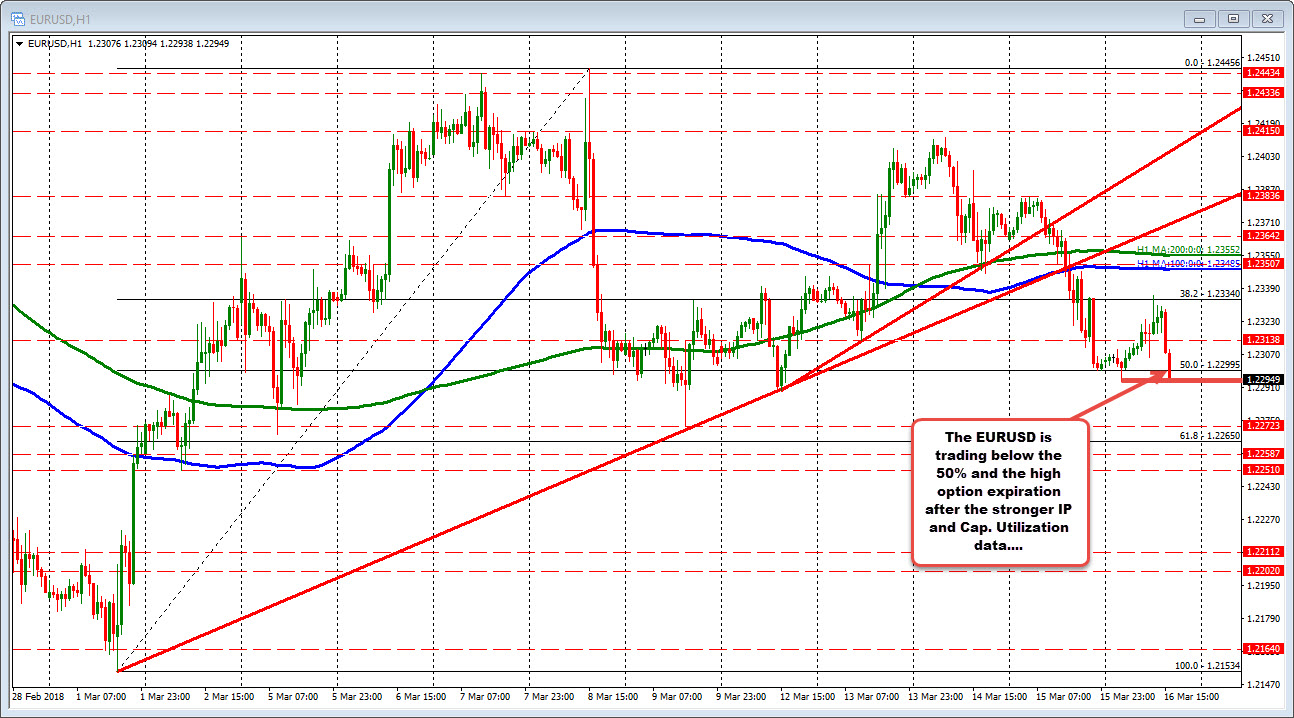

The EURUSD has moved lower and is down testing the 50% retracement at 1.2300 level. That is also the home of $2.8B of option expires (as per Mike's earller report).

The IP and Capacity Utilization data has just come out stronger than expectations and that has pushed the price of the EURUSD below the expiring level. The price is testing the low from earlier in the day at 1.2294. There should be some stall around this level.

Sellers of options have a incentive to have the price settle at the strike price (the price converges to $0.00 if it settles at the strike price. Sellers collect the entire premium as a result). If they are the dominant speculators, those sellers will look to stall the price around that level by entering the spot market. Buyers of options, who tend to be hedgers, are less price sensitive (generally).

After expiration (10 AM ET), it is open road without option influence for the rest of the day.