Still above recent lows

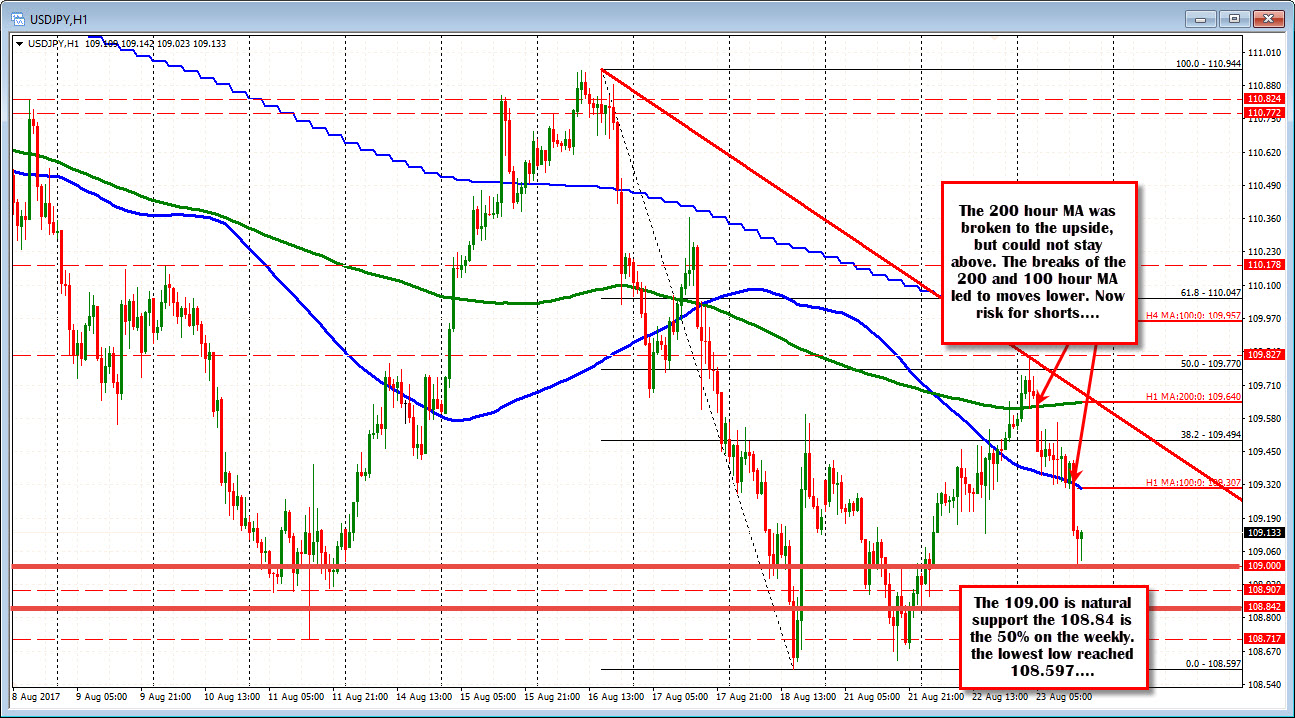

The USDJPY extended higher in the Asian session and in the process moved above the 200 hour MA and the 50% of the move down from the August 15 high (at 109.77). That move was bullish.

For 4 or so hours in those early hours of the day, the price tried to stay above the broken levels (50% and 200 hour MA). It could not.

ON the break of the 200 hour MA, the price tumbled to the 100 hour MA (blue line). For most of the European/London morning session that MA line provided a floor. As NY traders started to enter for the day, the MA line was broken and we are trading about 30 pips lower and testing the natural support at 109.00.

So the MAs provided the clues for the steps lower in trading today. The bears are more in control below them. Risk for shorts is the 100 hour MA today.

What next?

Well looking at the hourly chart, the natural support at 109.00 is stalling the fall (the low reached 109.01). On a break, the low for the week extended to 108.63 and that is a target.

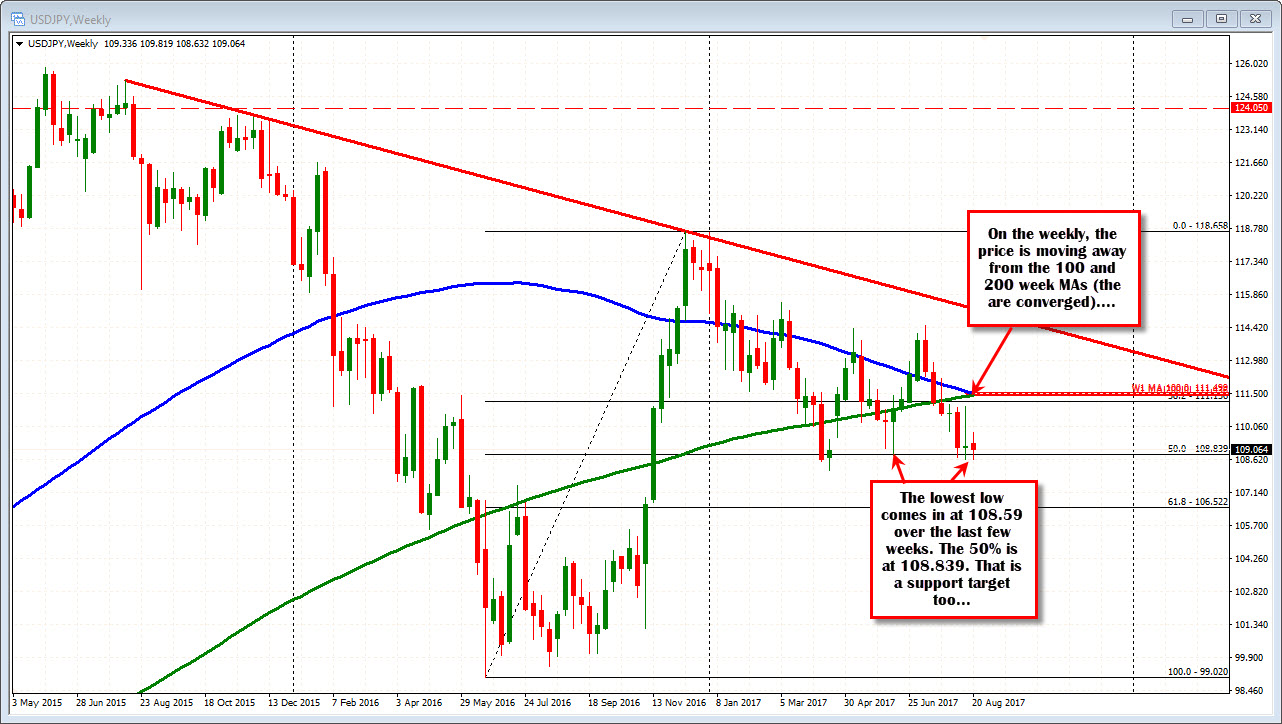

Above that pay attention to 108.84. That is the 50% of the move up from the 2016 low to the December 2016 high on the weekly chart below. The price has moved below that 50% level on a number of occasions, but has not been able to go far (the lowest low is 108.597 going back to June 2017). In June the low reached 108.79 - just below the level - before bouncing. So keep that level in mind on continued weakness today.