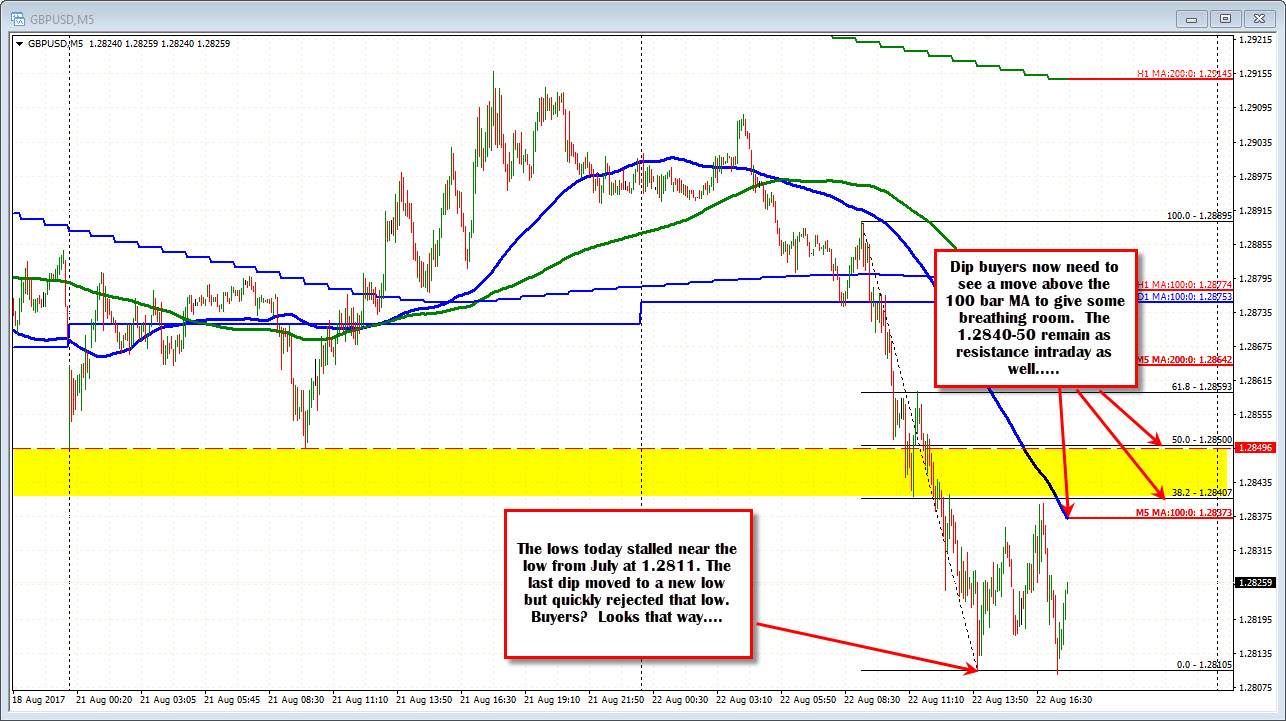

The July low at 1.2811 stalls the fall again (although there was a tiny break)..

As per an earlier post, the 1.2811 was the low in July 2017. The earlier low today reached 1.28108. Another run to the level just printed 1.28098, below the low for the day and the low from July but the price has rebounded and trades at 1.2822 currently.

Traders hate that....I should restate that...."Shorts hate that". A new intraday and two month low is reached and there is no momentum.

That puts doubt in the shorts and that could/should lead to covering from shorts and new buying from dip buyers who now have a triple bottom to lean against (with stops below the floor level). Traders will trade if risk is defined and limited. Risk is defined and limited against the floor at 1.2810-11 area.

On the topside, the dip buyers will be more comfortable on a move back above the 100 bar MA at 1.28379. That is the closest resistance level intraday. Above that the 1.2840-50 also remain as resistance. The lows from yesterday were at that level (see chart above). A move above 1.2850 gives buyers more comfort (at least they will have some additional chips to play with).

Buyers are making a play....