The USD is mixed today

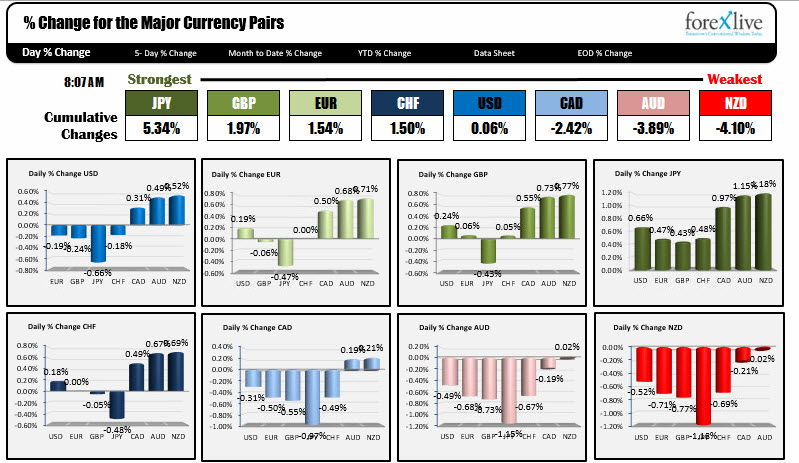

The JPY is the strongest currency of the day, while the NZD is the weakest. The USD is mixed at the start of the North American sessions with gains vs. the commodity currencies, and declines vs the rest.

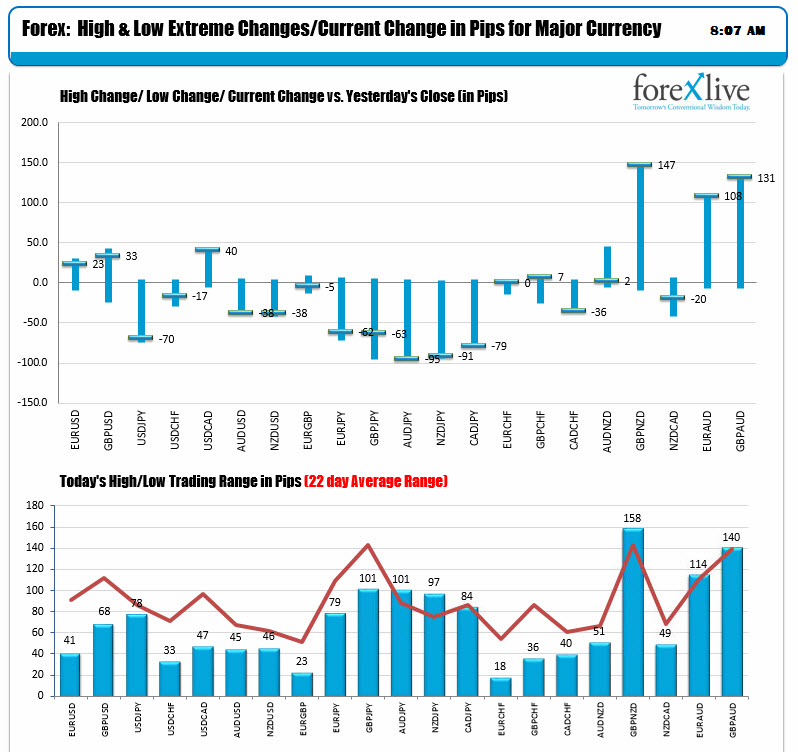

The JPY pairs are trading near their lows for the day and lead in the action (ranges are higher and close to their 22 day trading ranges - red lines in the lower chart below). The commodity currencies vs the USD (CAD, AUD and NZD) are also trading near their lows for the day.

It is Friday, there is a number of releases today. That can lead to end of week flows that push the prices one way or the other. For the EURUSD, Mike points out a large amount of settles at the 1.2300 level (2.8B). A move back toward that level might solicit some stall. Be aware.

IN other markets, the snapshot is showing:

- Spot gold is trading up $4.25 or 0.33% at $1320.61

- WTI crude oil futures are trading up $.17 or 0.25% at $61.35

- The price of Bitcoin is treating down -$25 and $8224.50. The price remains below its 100 hour moving average at $8704.12 (and moving lower) and its 200 day moving average at $9128.52.

- US yields are marginally lower: two-year 2.278%, -0.6 basis points. Five-year 2.618%, -0.7 basis points. 10 year 2.821%, -0.7 basis points. 30 year 3.050%, -0.8 basis points

- US stock futures are implying small openings. Dow futures imply a 9 point gain. NASDAQ futures imply a 9 point gain. S&P futures imply a 3.5 point gain.

- German Dax is up 0.2%. France's Cac is unchanged. UK FTSE is up 0.2%. Spain's Ibex is up 0.3%. Italy's FTSE MIB is up 0.5%.

- 10 year yields in Europe are lower-ish. Germany 0.574%, unchanged. France 0.817%, unchanged. UK .434%, and changed. Spain 1.360%, -2.2 basis points. Italy 1.959%, -2.8 basis points. Portugal 1.758%, -3.1 basis points