August 23 NY morning snapshot

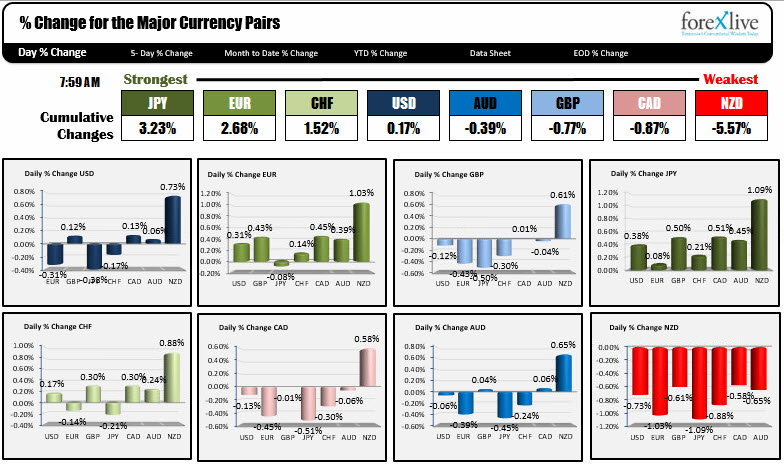

As the North American traders enter for the day the JPY is the strongest currency, while the NZD is the weakest. Stocks are weak. US interest rates are lower in the US open. That is helping to give a flight to safety bid to the JPY. The CHF is also seeing some flows. The NZD is being hit on the back of lower forecasts for growth/budget surpluses. It has been trending for most of the day.

The USD is mixed. It is highest vs. the NZD and marginally up vs the GBP, CAD and AUD. It is lower vs the EUR, JPY and CHF.

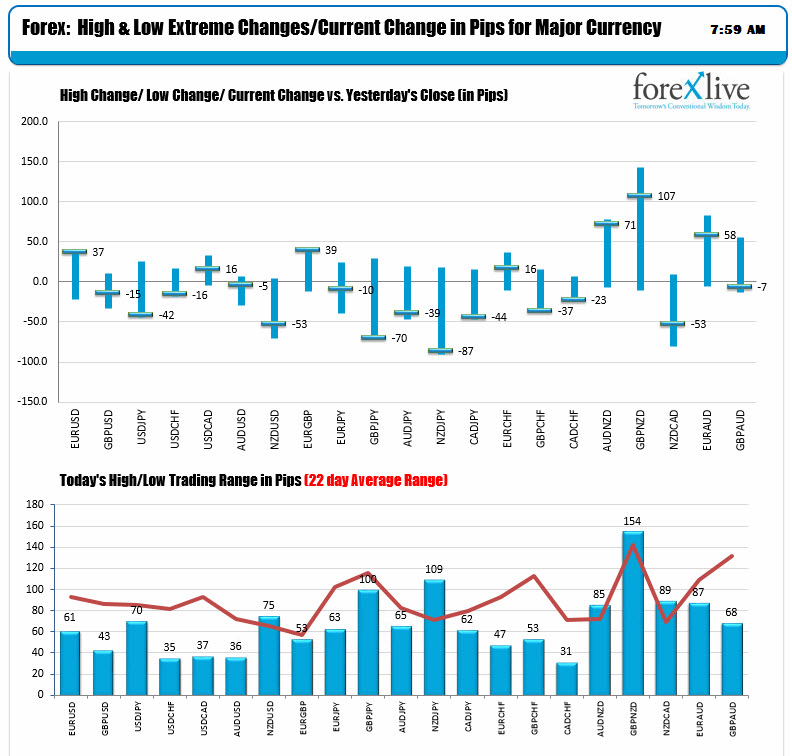

The volatility is mostly in the NZD pairs. Some JPY crosses are also on the move and trading at session lows as NY traders enter for the day. The EURUSD, USDJPY , USDCHF are also trading at session extremes.

A snapshot of other markets at the start of the day shows:

- Spot gold up $4.63 to $1289.89

- WIT Crude is down -$0.22 to $47.62. There was a draw in inventories of -3.595K. The DOE data is due at 10:30 AM/1430 GMT with -3.437K estimated

- US premarket stocks are lower. S&P is down -8.25 points. DOw futures are down -60 points. Nasdaq futures are down -20 points

- US yields are lower. 2 year is down 0.4 bp. 5 year is down -1.6 bp. 10 year is down -2.2 bp. 30 year is down 1.8 bp

- European stocks are unchanged to lower with the Dax down -0.3%, Cac down -0.1%. UK FTSE unchanged.