A little dollar selling as the London day comes to the finish

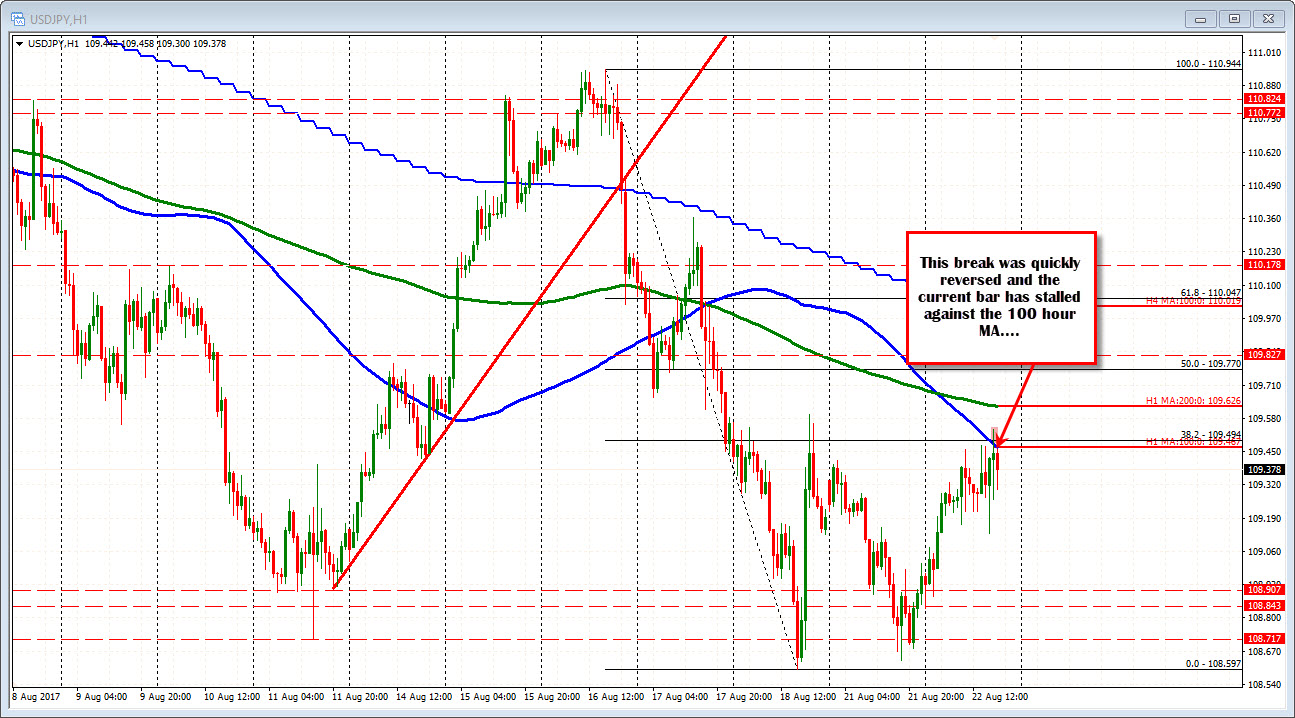

The USDJPY spiked above the 100 hour MA and the 38.2% of the move down from last week's high after the Richmond Fed data at 10 AM ET (at 109.47-49). The spike was quick. The break was rejected.

In the current hourly bar, the 100 hour MA has been a ceiling for the pair and we have seen a little rotation lower (see chart above).

Looking at the 5 minute chart, the 100 and 200 bar MA on the 5-minute chart have provided support on the most recent dips (there was a dip before the Richmond Fed that was rejected). A move below those MAs at 109.33 and 109.266 will be eyed by the sellers looking for more confirmation that the 100 hour MA is now a ceiling (at least for now).

The 109.08 is the 50% of the move up from yesterday's low. That level and the 109.00 are other downside targets for shorts. On the topside a move back above the 100 hour MA at 109.467 would likely lead to covering from the intraday sellers.