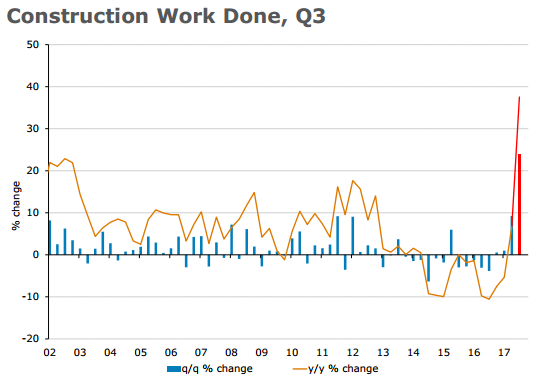

The thing about this data is it feeds into the GDP. So it can have an impact.

I posted a preview of it yesterday:

And this morning I posted what was the consensus expectations etc.:

- expected -2.3% q/q, prior +9.3%

More previews now, these via:

ANZ:

- Construction is expected to post significant growth in Q3,driven by the arrival of floating LNG platforms for the Ichthys and Prelude projects. Keep in mind though, that because these platforms have been imported, their net effect on Q3 GDP will be zero.

- Excluding this strong private engineering result, underlying construction still looks solid (+2.6% q/q).

- Housing construction is expected to post moderate growth after approvals rose in the quarter, while publicly funded work on road and rail projects should continue to rise.

Note ... ANZ's forecast is +24% (well above consensus of -2.3% and an outlier)

--

Westpac (forecast is -2.7% q/q):

- Currently, the Construction Work survey is an unreliable partial indicator for the National Accounts. Recently, LNG platforms have been imported. The survey includes the full value of the platform when it is imported, rather than actual work in the period, as in the national accounts

- In Q2, 'construction work' reportedly spiked, +9.3%,boosted by imported platforms (which is included in private infrastructure). For Q3, with fewer platforms imported(1 rather than 2), we expect a partial reversal, -2.7%. We caution, there is a high degree of uncertainty around this forecast - the value of these platforms is unclear, due to commercial in confidence

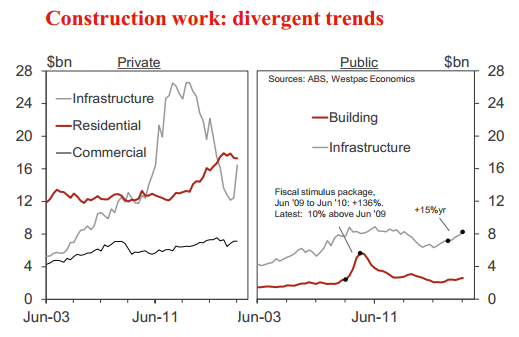

- Turning to private building and public works, activity in these areas grew by 1.2% in Q2 and we anticipate a further1.5% increase in Q3, with broad based strength, across

- residential, commercial building and public construction